Market Growth: Tempered Glass and Building Glass Take Center Stage

The global glass market, valued at **$125 billion in 2022**, is projected to grow at a 5.2% compound annual growth rate (CAGR) through 2030, with tempered and building glass as primary accelerators.

Tempered Glass: Safety Meets Versatility

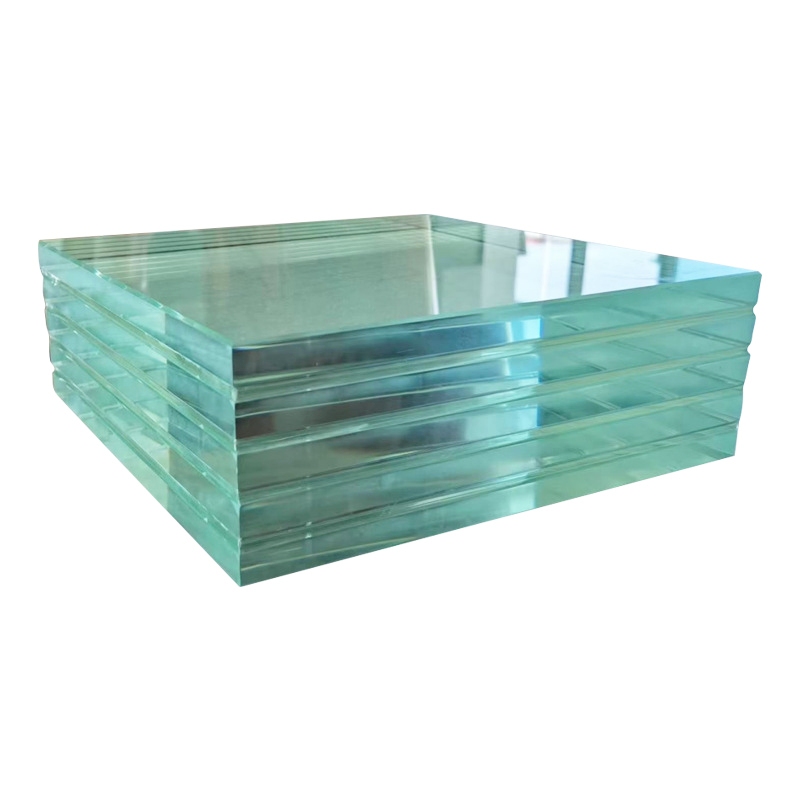

Tempered glass, processed to be 4–5 times stronger than regular glass, is indispensable in safety-critical applications:Image 1: [Insert image of tempered glass skyscraper facade or automotive application]

Caption: Tempered glass enhances durability in high-rise buildings and electric vehicles.Regional growth is uneven: Asia-Pacific dominates production (65% of global output), while Europe invests in tempered glass for energy-efficient retrofitting projects.

Construction: Used in balustrades, shower enclosures, and hurricane-resistant windows, its market share in building materials is rising by 7% annually (Frost & Sullivan).

Automotive: Accounts for 90% of side and rear vehicle windows due to shatterproof properties. EV makers like Tesla are integrating tempered glass roofs for lightweighting.

Consumer Electronics: Smartphone screens and smart home devices rely on tempered glass for scratch resistance and touch sensitivity. Samsung’s foldable phones, for instance, use ultra-thin chemically tempered glass.

Building Glass: The Engine of Sustainable Design

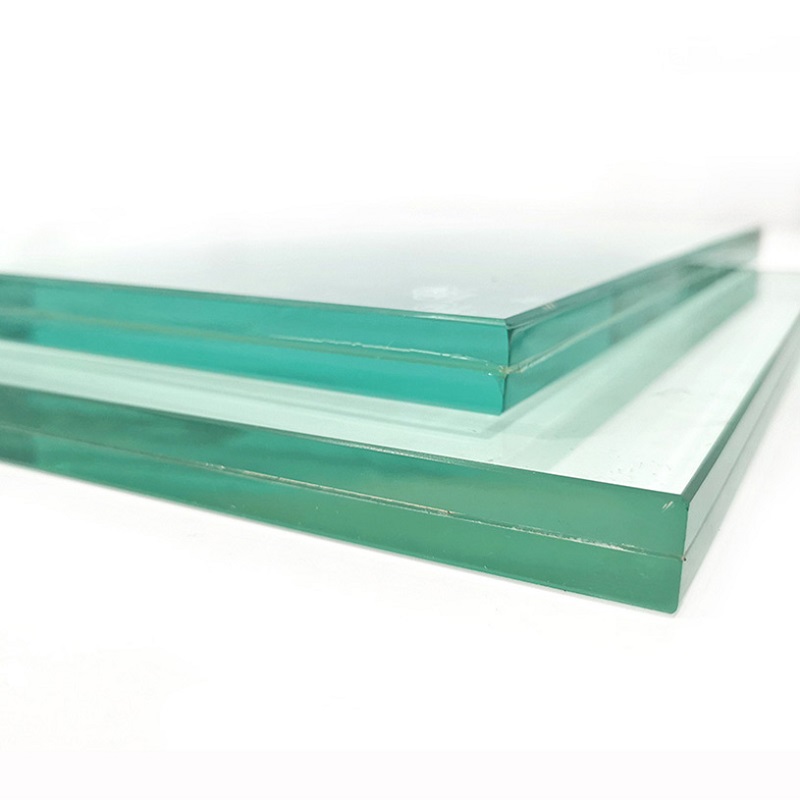

Building glass, including Low-E coatings and insulated glazing units (IGUs), is central to green architecture:Image 2: [Insert image of double-glazed building glass with solar panels]

Caption: Modern buildings combine building glass and solar technology for net-zero energy goals.Asia-Pacific leads demand, with China’s urbanization spurring a **$12 billion annual building glass market**. India’s National Building Code mandates double-glazed windows in metro cities, further boosting growth.

Energy Efficiency: Low-E glass reduces building energy consumption by up to 35%, per the U.S. Department of Energy. The EU’s Green Deal mandates its use in all new public buildings by 2027.

Smart Glass: Electrochromic glass, which adjusts tint based on sunlight, is gaining traction in skyscrapers like The Edge in Amsterdam, cutting HVAC costs by 20%.

Circular Design: Recycled glass content in building materials now exceeds 30% in the EU, driven by mandates like France’s AGEC law.

Key Drivers and Innovations

1. Sustainability Pressures

Carbon Neutrality Goals: Tempered glass production, energy-intensive due to high-temperature furnaces, is adopting hydrogen combustion trials. AGC Inc. (Japan) aims for net-zero emissions by 2050 via hydrogen-powered kilns.

Circular Economy: Building glass recycling rates hit 90% in the EU, with startups like TerraCycle repurposing scrap glass into insulation materials.

2. Technological Breakthroughs

Tempered Glass Innovations:

Self-Cleaning Coatings: Hydrophobic films reduce maintenance costs for solar panels and skyscraper glass.

Bulletproof Tempered Glass: Rising demand in Middle East “smart cities” like NEOM for blast-resistant windows.

Building Glass Advancements:

Solar-Active Glass: Bifacial solar panels with tempered glass backing boost energy output by 20%.

Photovoltaic Glass: Transparent solar cells embedded in building facades generate renewable energy (e.g., Ubiquitous Energy’s product).

3. Regulatory Pushes

The EU’s CBAM (2026) taxes imports based on carbon footprint, favoring locally produced Low-E glass.

U.S. tax credits under the Inflation Reduction Act incentivize building glass retrofits, projected to save $50 billion in energy costs by 2030.

Challenges: Balancing Growth and Costs

Raw Material Shortages: Silica sand scarcity and soda ash price spikes (+40% in 2022) strain production.

Energy Prices: Tempered glass manufacturing, requiring 7–10 GJ per ton, faces margin squeezes as gas prices surge.

Labor Gaps: Automation adoption is rising, with AI-driven quality control systems cutting defect rates by 30%.

Regional Spotlight

Asia-Pacific: China produces 70% of global tempered glass, but environmental crackdowns are consolidating smaller players. India’s Ambuja Cements plans $1.2 billion investments in solar-active building glass.

Europe: Schott AG leads in tempered glass for EVs, while Saint-Gobain’s flat glass division targets a 40% recycled content target by 2030.

North America: The IRA spurred a wave of factory expansions, including NSG Group’s $300 million plant in Texas for architectural glass.

Future Outlook: Collaboration and Resilience

The future of tempered and building glass lies in cross-industry partnerships:

Smart Cities: Projects like Saudi Arabia’s The Line will rely on tempered glass for safety and photovoltaic glass for energy.

Circular Design: Bio-based coatings (e.g., algae-glass hybrids) could replace petroleum-based films by 2030.

Hydrogen Economy: Trials in Germany and South Korea aim to decarbonize glass furnaces, reducing emissions by 70%.

Analysts predict that by 2030, tempered and building glass will account for 40% of industry revenue, fueled by urbanization, green policies, and smart technology integration.

Conclusion

In 2023, tempered glass and building glass are not just materials but cornerstones of innovation in safety, sustainability, and energy efficiency. As cities grow taller and greener, these industries will face challenges like raw material shortages and regulatory shifts. Yet, with breakthroughs in hydrogen kilns, self-cleaning coatings, and solar-active designs, the glass sector is poised to redefine resilience. For companies investing in R&D and circular practices, the future is as clear as tempered glass itself—strong, adaptable, and full of light.